12+ Irs Disagreement Letter

If a taxpayer fails to protest or resolve the case at IRS Appeals the IRS will send an IRS Notice of Deficiency via certified mail. Web A senior Democratic aide said the Biden-McCarthy deal included 202 billion in IRS cuts spread over two years.

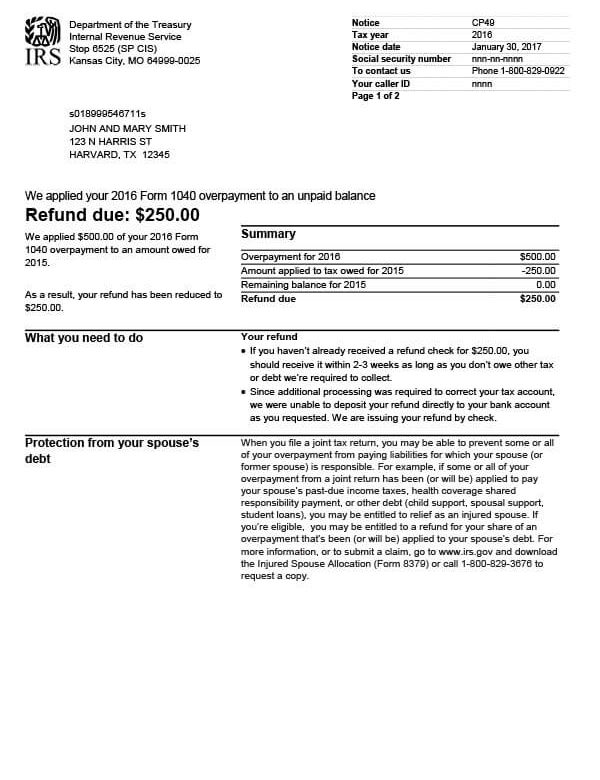

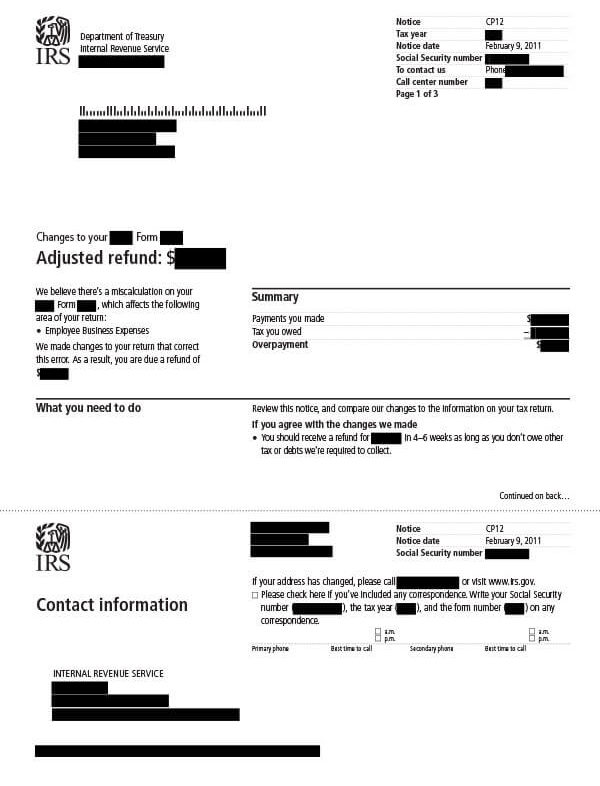

Irs Letter Notice Cp11 Cp12 Cp13 And Cp14 For Refund Adjustments Or Additional Tax Liability Aving To Invest

Web This letter is to notify you the IRS filed a notice of tax lien for unpaid taxes.

. Format the Letter Step 3. They should send it to the address on the contact stub. Write a formal protest letter that.

Mail your request by certified mail to the appeals address referenced in your decision. Get legal services you can trust at prices you can afford. The introduction should include a clear.

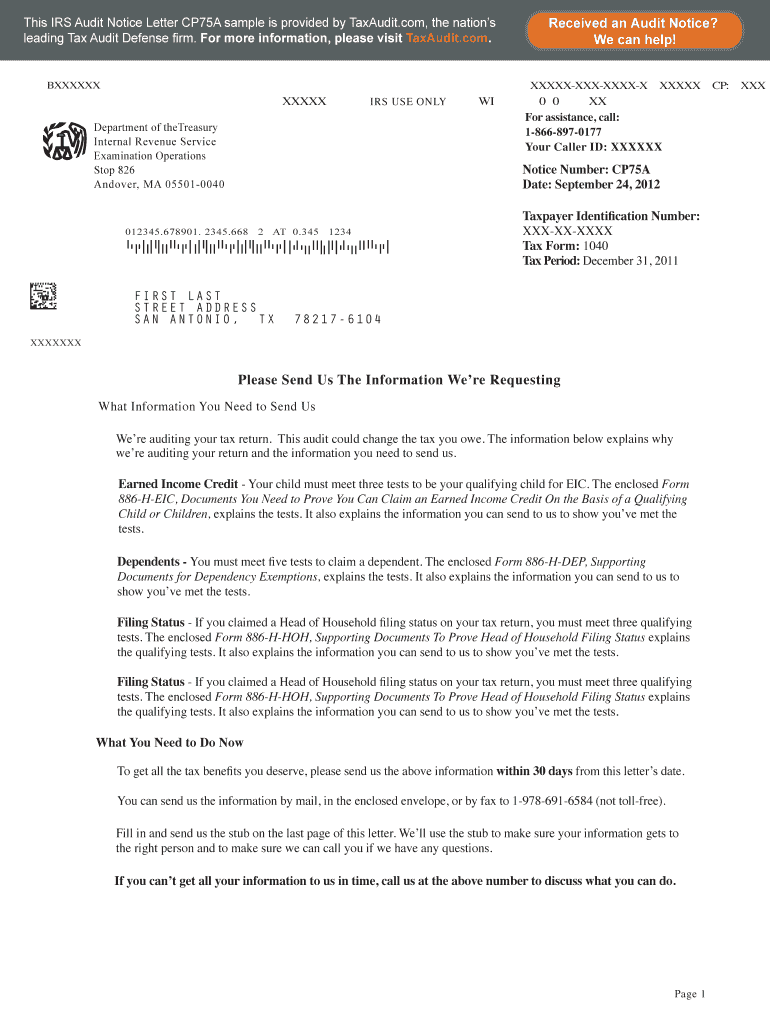

Web Beware a Notice of Deficiency. The new agreement with Johnson just means theyll. The IRS corrected one or more mistakes on your tax return.

Web Would you like to take steps to prevent a dispute or do you disagree with a decision made by the IRS. Our agency offers several options for taxpayers to resolve. 14K views 2 years ago.

A CP12 Notice is sent when the IRS corrects one or more mistakes on your tax. Web Typically if you disagree with the determination by the IRS you should file a Protest with the office issuing the letter within thirty 30 days. The notice you receive.

If this message is not eventually replaced by the proper contents of the document your PDF viewer may not be able to display this type of document. Web Former IRS Agents Reveals How To Write a IRS Penalty Abatement Letter 2 The IRS What To Include. Web Up to 24 cash back Start your Response to IRS Notice now and get Rocket Lawyer FREE for 7 days.

A disagreement letter should have a clear structure that includes an introduction body and conclusion. Begin with a Polite and Respectful Tone Step 4. Web If a taxpayer doesnt agree with the IRS they should mail a letter explaining why they dispute the notice.

455 69 reviews. Web Notice Overview. Web Most IRS letters have two options.

Clearly State the Relevant Facts and. Gather Necessary Information Step 2. How to Write a Tax Protest Letter.

Web You have 30 days from the date of the letter to file a written protest that explains why you disagree with the IRSs decision. Web Johnson was also successful at hacking away at the side agreement negotiated alongside the debt limit deal by ensuring emergency funding stays at the. Web You will get either a CP-2501 noticea letter asking you to explain CP means computer paragraphor a CP-2000 notice proposing additional tax penalties.

Web The letter acts as a helper for a taxpayer to argue their case for why they believe a reduction in the amount of a penalty or a total cancelation of the penalty is. The letter is not an audit. If you disagree you can request appeals consideration within 30 days from the date of the.

Agree with the changes the IRS is making or send a written explanation of why the IRS is wrong and you are right. Make a copy of the original decision letter and attach it to your letter or appeals form. Web A CP2000 notice is a letter from the IRS alerting taxpayers that their reported income does not match that computed by the agency.

Web Step 1.

Caleb Followup To Deacons Dear Vision Baptist

Irs Notice Cp49 Tax Defense Network

Letter To Irs Template Fill Out Sign Online Dochub

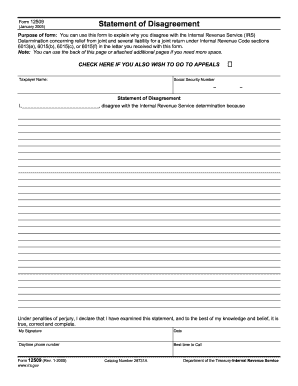

2018 2024 Form Irs 12509 Fill Online Printable Fillable Blank Pdffiller

Irs Tax Notices Letters

How To Respond To Irs Cp2501 Notice

Syosset Advance 12 16 22 By Litmor Publishing Issuu

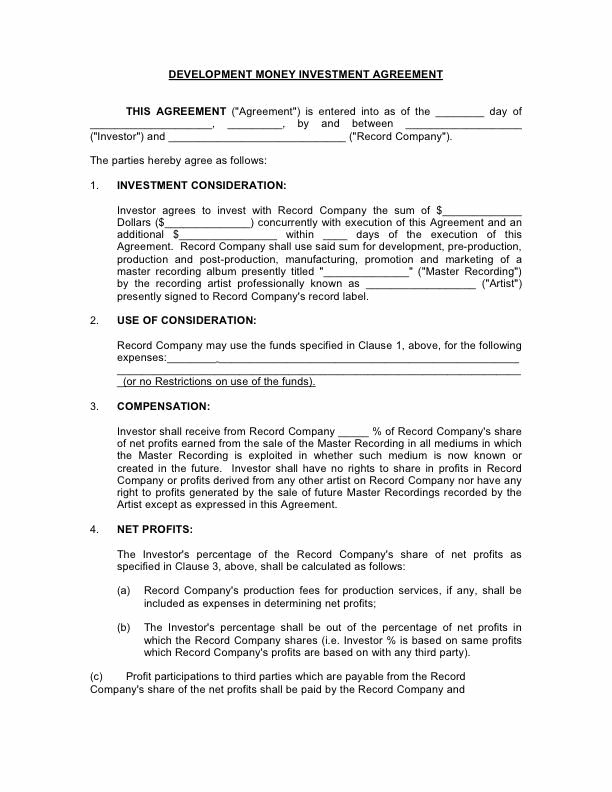

Business Investment Agreement 12 Examples Format Pdf Examples

Irs 12509 Form Pdffiller

Free Response To Irs Notice Make Download Rocket Lawyer

Irs Notice Cp12 Tax Defense Network

Calameo 17 3 02497 31 Sally Jo Price Vs Charles Allen Price Jr

Sec Filing Vroom Inc

Irs Audit Letter Cp134b Sample 1

Irs Letter 556 Acknowledgement Of Protest Correspondence Or Request For Interview H R Block

How To Write A Disagreement Letter To The Irs Livewell

How To Respond To A Letter From Irs Tax Expert Advice